Executive Summary

The U.S. solar market in late‑2025 is being pulled in opposite directions. Monetary policy easing has started to reduce borrowing costs, but interest rates remain high compared with pre‑2022 levels. Installation volumes fell sharply in Q2 2025 even though solar continued to dominate new power additions. Domestic manufacturing is ramping up across the entire supply chain, leading to growing module, cell, inverter and battery capacity. At the same time, policy changes such as the One Big Beautiful Bill Act (OBBBA) and Foreign Entities of Concern (FEOC) rules are shortening the window for tax incentives and restricting the use of components linked to specified foreign entities. Module prices rose in Q3 2025 due to safe‑harbor deadlines and trade rules, but projections suggest prices will decline gradually as domestic capacity scales. This report integrates monetary policy signals, supply‑demand data and cost projections, and provides a probability‑of‑success assessment for the U.S. solar market.

Monetary Policy Context

- Federal funds rate: On 29 October 2025 the Federal Open Market Committee lowered the target range for the federal funds rate by ¼ percentage point to 3.75–4 percent and decided to conclude the reduction of its aggregate securities holdings on 1 December 2025.

- Second cut of 2025: Trading economics notes that the October rate cut followed a similar reduction in September and brought borrowing costs to their lowest level since 2022.

- Risks and inflation: Policymakers cited increasing downside risks to employment while inflation remained elevated.

Implications for Solar Financing

Lower rates modestly improve financing for capital‑intensive projects, but the new range (around 3.75 % to 4 %) still creates a relatively high cost of capital. Residential and community‑scale projects continue to face weak demand because high rates and economic uncertainty limit consumer borrowing.

Demand Outlook

- Installations: The Solar Market Insight Q3 2025 report shows the U.S. installed 7.5 GWdc of solar capacity in Q2 2025, a 24 % decline from Q2 2024 and a 28 % decrease since Q1 2025. Residential installations declined 9 % year‑over‑year due to high interest rates and economic uncertainty.

- Market share: Solar still supplied 56 % of all new electricity‑generating capacity in the first half of 2025, reflecting structural demand even amid headwinds.

- Deadline rush: A rush to meet a 2 September safe‑harbor deadline for the Investment Tax Credit pulled demand forward. Median module prices on Anza’s platform increased 3.7 % (about $0.015 per watt) from June to August, returning to $0.28 per W. Prices for FEOC‑noncompliant modules rose 9.2 % while FEOC‑compliant modules increased 4.9 %.

- Policy headwinds: Under the OBBBA, projects starting after 4 July 2026 must be placed in service by the end of 2027 to receive 48E or 45Y tax credits. FEOC rules limit the share of project costs that can be paid to specified foreign entities—40 % in 2026 rising to 60 % by 2030. Adding complexity to procurement.

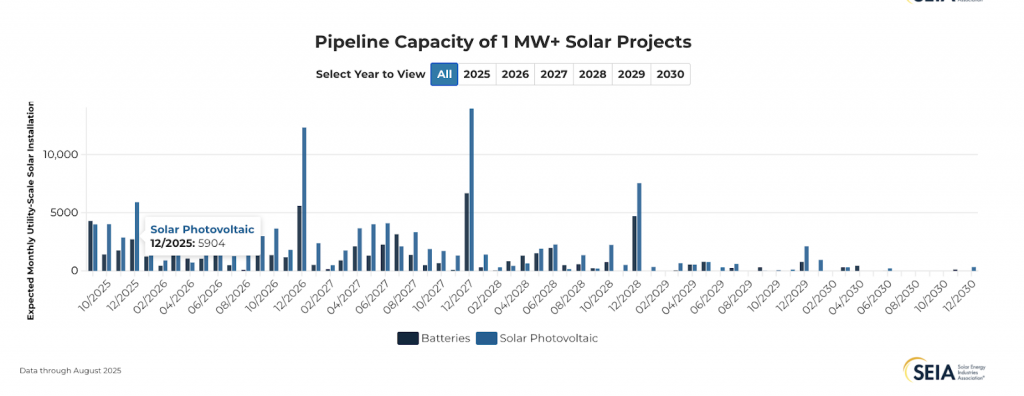

Pipeline Capacity Outlook

The SEIA pipeline dataset provides monthly estimates of expected utility‑scale solar installations (solar PV and battery projects) for projects greater than 1 MW. Data through August 2025 show that the pipeline is strongly seasonal, with significant year‑end spikes driven by tax credit deadlines and safe‑harbor requirements. The chart below illustrates the 2025 outlook, where September to December 2025 show total expected installations between about 5.4 GW and 8.6 GW (solar PV plus batteries). Notably, December 2025 has roughly 5.9 GW of solar PV installations and 2.7 GW of battery storage expected to come online, reflecting developers’ rush to complete projects before year‑end. Earlier months such as September 2025 include roughly 4.0 GW of solar PV and 4.2 GW of battery projects.

Figure 5 – Monthly pipeline capacity for 2025 from SEIA’s Major Projects List (data through Aug 2025). The data underscore that even if installation volumes slowed in mid‑2025, a large backlog of projects is scheduled for completion in late 2025.

Beyond 2025, the SEIA dataset projects multiple large waves of utility‑scale solar installations. Major spikes occur in December 2026, December 2027, February 2028, December 2028 and February 2029, each representing several gigawatts of expected solar PV capacity. These peaks are associated with tax credit phase‑outs and safe‑harbor deadlines. The pipeline gradually declines after 2030 but remains active through the end of the decade, indicating a sustained level of planned development.

Figure 6 – Expected monthly utility‑scale solar installations (PV and batteries) by month from 2025 through 2030 (data through Aug 2025). Significant spikes are visible at the end of each year.

These pipeline trends support the notion that demand has been timing‑shifted rather than destroyed. They also highlight the importance of ensuring supply chain readiness and permitting capacity to accommodate large year‑end surges.

Supply & Manufacturing

- Domestic capacity: SEIA’s Supply Chain Dashboard, summarised by Solar Power World, shows U.S. manufacturing capacity expanding across every segment. Domestic module capacity exceeded 60 GW in October 2025, a 37 % increase since December 2024.

- Cell and battery growth: Solar cell production capacity more than tripled, rising from 1 GW to 3.2 GW. Battery cell manufacturing for stationary storage grew to over 21 GWh.

- Inverter and tracker production: U.S. inverter capacity rose from 19 GW to 28 GW and mounting‑system capacity continued to expand. The manufacturing pipeline includes 23 GW of module capacity and more than 34 GW of cell capacity under construction or announced.

- Upstream bottlenecks: SEIA reports the U.S. added 4.3 GW of module manufacturing capacity in Q2 2025 but no significant new polysilicon, wafer or cell facilities, highlighting continued reliance on global upstream supply for key inputs.

Price Trends & Cost Projections

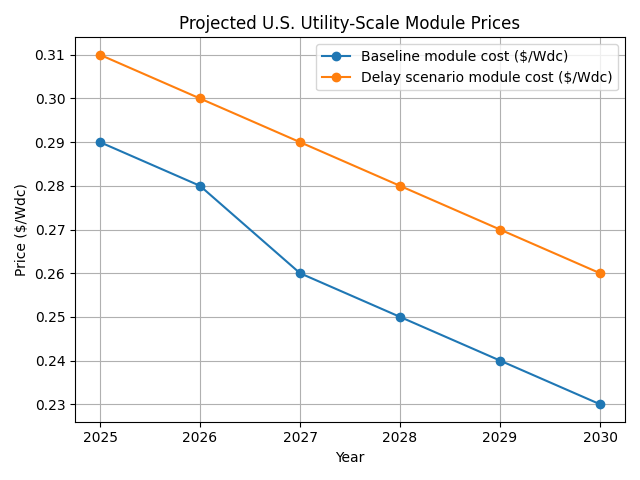

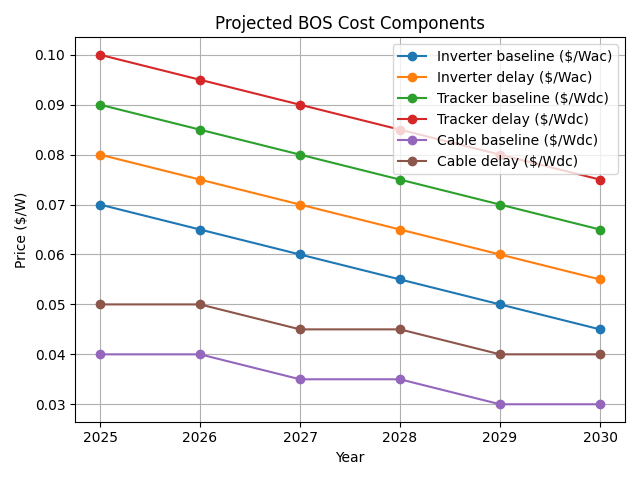

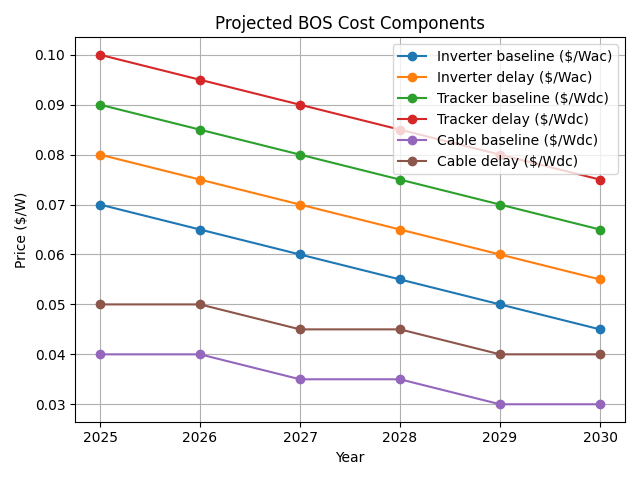

The figures below depict projections for module prices, balance‑of‑system (BOS) costs and storage costs under baseline and delay scenarios.

Figure 1 – Projected utility‑scale module prices. The baseline scenario assumes steady cost declines as domestic manufacturing scales, while the delay scenario assumes persistent trade or policy disruptions.

Figure 2 – Projected balance‑of‑system costs. Inverters, trackers and cabling show gradual declines; delay scenarios assume slower cost reductions due to supply constraints.

Figure 3 – Projected utility‑scale battery storage costs for four‑hour systems. Battery pack and full‑system costs continue to fall faster than module or BOS costs.

Findings

- Module pricing: The Q3 2025 median price of ~$0.28 per watt serves as the baseline. Under baseline assumptions, prices decline to roughly $0.23 per watt by 2030 as domestic capacity scales and global oversupply persists. Delay scenarios keep prices about 2 ¢ per watt higher through 2030.

- BOS costs: Inverter, tracker and cabling costs decline modestly. The baseline reflects incremental improvements and local manufacturing growth; the delay scenario accounts for higher steel prices and logistical bottlenecks.

- Storage costs: Battery pack prices declined to about $110 per kilowatt‑hour in 2025 and are projected to reach around $80 per kilowatt‑hour by 2030 under baseline assumptions. Delay scenarios reflect slower cost reductions due to supply‑chain disruptions.

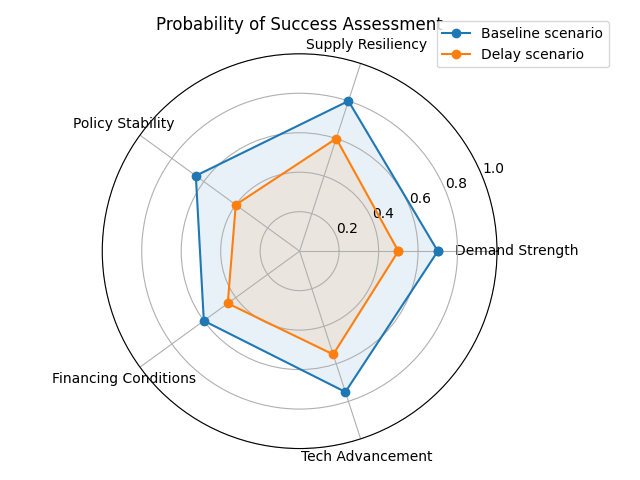

Probability‑of‑Success Assessment

The radar chart below shows a qualitative probability‑of‑success measure for the U.S. solar market (values range from 0 to 1). Criteria include demand strength, supply chain resiliency, policy stability, financing conditions and technological advancement.

Figure 4 – Probability‑of‑success assessment. The baseline scenario (blue) reflects moderate strength in demand and supply chain resiliency but limited policy stability. The delay scenario (red) shows lower probabilities across most dimensions due to policy and trade uncertainties.

Interpretation

- Demand strength (0.7 baseline vs 0.5 delay): Demand is resilient because of strong power‑market fundamentals and safe‑harbor deadlines. High interest rates and policy uncertainty dampen demand in the delay scenario.

- Supply resiliency (0.8 vs 0.6): Domestic manufacturing expansion improves supply security. Delay scenarios incorporate risks from additional tariffs or FEOC restrictions.

- Policy stability (0.65 vs 0.4): The baseline assumes that OBBBA and FEOC rules are clarified and implemented smoothly. The delay scenario reflects ongoing legal and administrative uncertainty and potential changes in the political environment.

- Financing conditions (0.6 vs 0.45): Lower interest rates modestly improve financing, but rates remain high relative to earlier years and policy risks raise the cost of capital.

- Technological advancement (0.75 vs 0.55): Rapid improvements in module efficiency (e.g., TOPCon and N‑type technologies) and storage systems support the baseline scenario. Delay scenarios consider intellectual‑property concerns and supply constraints that slow adoption.

Conclusion & Recommendations

Monetary policy easing has begun to lower borrowing costs, but the U.S. solar market faces a combination of economic headwinds and policy uncertainty. Recent data show that installations fell in Q2 2025 even as the domestic supply chain expanded rapidly. Module prices rose in Q3 2025 due to safe‑harbor deadlines and FEOC restrictions, but projections indicate gradual declines as domestic manufacturing scales. BOS and storage costs continue to fall, though at different rates.

Add comment